Poland’s booming furniture industry hit by soaring wood prices and consumer belt tightening

By Anna Rzhevkina

Poland is one of the world’s top rated 5 exporters of furnishings, but the field – which accounts for 2{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} of nationwide GDP and employs all over 200,000 individuals – struggled in 2022 and is fearful around itsf potential.

During the pandemic, Poland’s furnituremakers flourished, as men and women targeted on residence improvements for the duration of lockdown. Nevertheless, that increase has now finished and the business suffered a tough 2022.

The worldwide financial disaster induced by Russia’s invasion of Ukraine, which fuelled rising inflation and disrupted worldwide trade, has compelled shoppers to slice back again on spending. Wholesale wood charges have also risen at double-digit rate and, in intense cases, they doubled in contrast to 2021, lifting production charges.

Poland’s wood marketplace in crisis, as raw substance selling prices are envisioned to skyrockethttps://t.co/Io66ZFUcLw

— Timber Marketplace Information (@timber_news) October 13, 2022

Orders for Poland’s home furnishings producers have fallen involving 35{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} and 50{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} considering the fact that the commencing of 2022, claims Michał Strzelecki, director of the Polish Chamber of Commerce of Home furniture Companies (OIGPM).

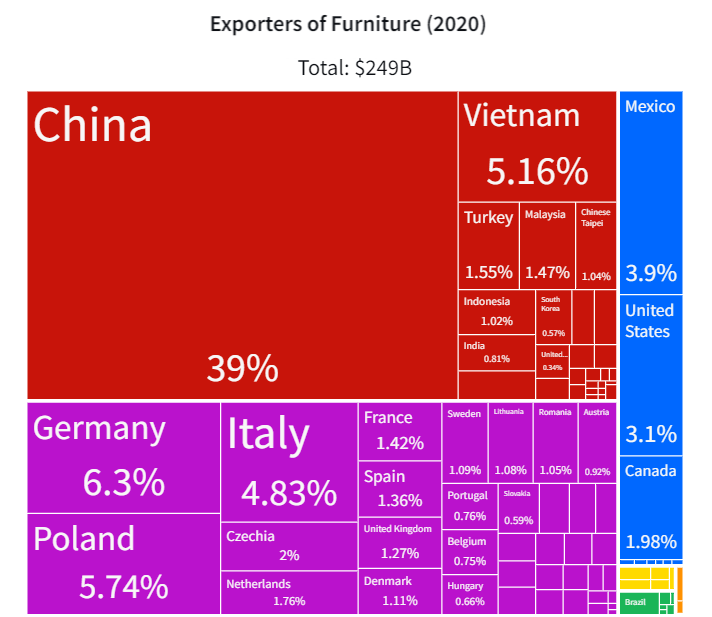

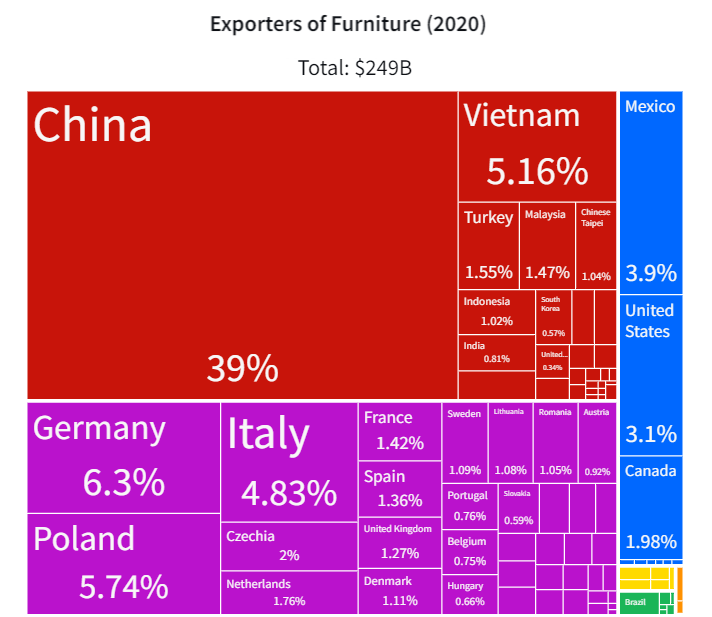

About 90{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} of Polish-created household furniture goes for export. In 2020, Poland’s 5.75{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} share of the world wide home furniture export industry was guiding only Germany (6.3{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df}) and China (39{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df}), according to the Observatory of Financial Complexity. A report released previous year by OIGPM puts Poland fourth, with a 5{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} share, guiding Italy as very well as Germany and China.

The marketplace, which finished 2021 with file sales of approximately 60 billion zloty (€12.8 billion), accounts for around 2{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} of Poland’s GDP. That is the best figure among any EU member point out and compares to a .7{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} share across the bloc as a whole.

Exporters reward from Poland’s furniture-producing custom and know-how, its geographical proximity to the main income marketplaces, aggressive transportation rates, and the comparatively reduced labour fees when compared to western Europe.

Resource: OEC

Refurbishing boom finishes

But this accomplishment tale is now under menace – at least for the around long run.

Strzelecki believes many buyers have postponed buys of home furnishings, and it is really hard to estimate when desire will choose up once more. “We assume this to take place only in the next fifty percent of 2023. This is a worst-case state of affairs, in which we will have to minimize production potential, and as a end result, layoffs will stick to,” he warns.

The Polish home furnishings sector employs about 200,000 people, and Strzelecki estimates that up to 20-25{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} of that workforce could shed their work opportunities. “The layoffs are already going on. But so significantly organizations are trying to keep the most critical and skilled staff,” he says.

In Poland by itself – wherever inflation has been jogging at a 25-calendar year high of in excess of 16{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} considering that August – footfall in important property enhancement suppliers, such as Leroy Merlin, Jula, and OBI, fell on regular by 25{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} this year, experiences the Rzeczpospolita day-to-day. In 2023, 30{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} of people program to lessen shelling out on household furniture, it provides, citing a study by consulting corporation OC&C.

Inflation slowed to 16.6{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} in December, down below economists’ forecast of 17.3{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} and down from 17.5{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} in November.

Experts consider, nonetheless, it will accelerate again this yr, maybe peaking earlier mentioned 20{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} in February.

Yesterday the central lender held its benchmark desire rate at 6.75{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} pic.twitter.com/l7Pf98EWDH

— Notes from Poland 🇵🇱 (@notesfrompoland) January 5, 2023

Rafal Szefler of the Polish Chamber of Commerce of the Timber Market confirmed to Notes from Poland that home furniture sales have dropped sharply. “People at present are worried about shopping for bread, butter and milk, not about refurbishing their residences,” he says.

Wood charges jump

To compound the slide in demand from customers, there has also been a major rise in wood charges in the Polish wholesale market place, which are now comparable to fees in Germany and Sweden, in accordance to Strzelecki.

Economic recovery soon after the pandemic stimulated need for wooden, though sanctions imposed on Russia and Belarus after the invasion of Ukraine restricted supply. Simultaneously, State Forests, the body that manages Poland’s forests, introduced a new price-setting policy.

Poland encourages people to gather firewood in forests amid soaring vitality costs

In 2021, Point out Forests elevated the share of open up auctions to 30{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} from 20{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} with shut auctions therefore decreased to 70{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} from 80{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df}. Shut auctions are reserved for customers who built purchases from State Forests in prior decades, and costs are usually decrease in contrast to open up bids.

Aneta Muskała, President of the Affiliation of Polish Papermakers, told Notes from Poland that the general volume of wooden presented to the field has also lessened in contrast to previous decades. As a consequence, price ranges grew sharply, specially in open up auctions, Muskała says.

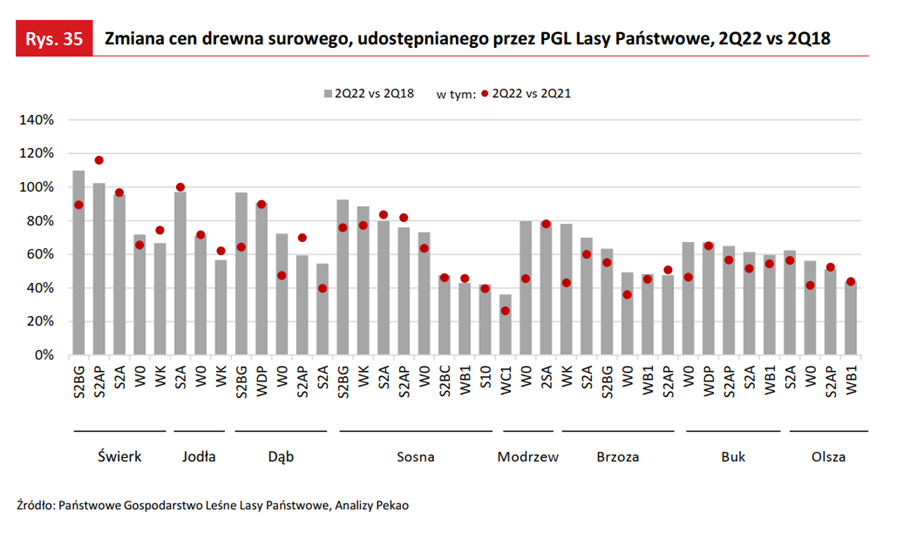

In the second quarter of 2022, average rates for virtually all wooden styles in Poland have been tens of per cent better than a 12 months previously, and in excessive instances they doubled, in accordance to a report by Bank Pekao.

For example, costs for beech timber at open auction in the 2nd 50 {833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} of 2022 averaged 613 zloty per cubic meter, more than double the 305 zloty in the exact period of 2021. Prices for birch skyrocketed to 626 zloty from 185 zloty, the report demonstrates.

Variations in price ranges for several types of wood marketed by Poland’s Point out Forests (source: Bank Pekao)

Condition Forests spokesperson Michał Gzowski acknowledges that selling prices have absent up, but characteristics the improve to the financial recovery soon after the pandemic. The desire for wood is escalating, whilst the provide is restricted by forest regeneration options, he claims.

“Businesses that benefit from higher revenue from generation are competing for accessibility to wood, and charges are climbing,” Gzowski explained to Notes from Poland.

Side results of sanctions

Whilst wood charges have risen throughout the continent, ResourceWise, an analytics business, observed in November that Central Europe has viewed the maximum will increase, with sawlog prices almost doubling around the previous two yrs.

By comparison, the World wide Sawlog Price tag Index (GSPI), representing 20 locations around the globe, amplified by 34{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} above the two several years to Oct 2022.

As manufacturing costs increase, brands have to take decrease margins. The Polish home furnishings business finished 2021 with document revenue but also the cheapest profitability in 3 a long time, in accordance to OIGPM.

In addition, levels of competition with producers from Romania, Bulgaria, and Belarus has intensified. Paradoxically, Belarus has strengthened its placement on the home furniture current market just after the introduction of sanctions, Strzelecki claims.

Polish and German parliaments’ international affairs committees jointly phone for more durable Russian sanctions

“The sanctions are not reliable. Poland simply cannot invest in raw materials from Belarus, so it misplaced the current market to acquire panels or raw wood. But at the exact time there is no ban on household furniture, which is about 30-40{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} more cost-effective when compared to Polish home furnishings,” he defined.

Belarus, and to a lesser extent Ukraine and Russia, utilised to be an important resource of Polish timber imports and wooden products and solutions. Just before the war, Poland imported almost 40{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df} of its semi-completed wood goods from these countries, in accordance to Lender Pekao.

In 2023, OIGPM expects a even more slide in generation quantity of up to 30{833736ef333566f6502cdebaaa8c1006aee7f6f644158cfddacfa746ee20c4df}. “It’s tough to see the new calendar year with any optimism,” concludes Strzelecki.

Principal picture credit: Fabryka Wersal pod Kępnem (push products)